The Republic of Somaliland Oil Exploration Production

Somaliland Block SL10B/13

Company Profile – Genel Energy

◼ Anglo-Turkish E&P company – listed on the London Stock Exchange (LSE)

◼ Operations

◼ Kurdistan Region of Iraq (largest holder of reserves & resources)

◼ Africa

◼ 3 Producing oil fields

◼ Taq Taq (44%) Tawke(25%) and Peshkabir (25%)

◼ Current net production c.36,500 BOPD

◼ Upside from E&A / pre-production assets

◼ Bina Bawiand Miran(100%) oil & gas developments

◼ QaraDaghappraisal (40%)

◼ Sarta(30%) pre-production

◼ 150 MMBOE net 2P Reserves

◼ 5.5 BBOE net reserves and resources

◼ Africa – High-value, Low-cost Exploration

Africa – Organic Value Creation Through Low-cost Exploration Somaliland

SL10B/13 75% Op

Prospect Inventory Build

Odewayne 50% Op

Seismic processing/interpretation

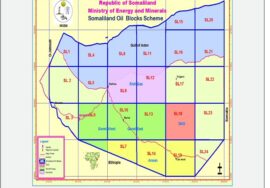

Somaliland Licence Position

Facts and Figures

Population – c.3.5 million

Geopolitical History

◼ 1888 –British Somaliland (Protectorate)

◼ 1960 –Somali Republic

◼ 1988 –onset of civil war

◼ May 1991 –Somaliland local government declared ‘independence’.

◼ 2019 –28 years of democracy and 5 democratically elected presidents.

Economy

◼ GDP per capita last estimated at US$347 (World Bank) – amongst lowest in the

world.

◼ C.30% of GDP from livestock.

◼ FDI historically low

Why Somaliland?

◼ The Geology –the Yemen Analogue

◼ Prior to the opening of the Gulf of Aden c.20my ago the Somaliland rift basins were

broadly contiguous with the prolific rift basins of Yemen –home to >7BBOE of 2P

reserves.

◼ Specifically Nogal-DabanLate Jurassic rift was contiguous with the Sab’ataynrift.

◼ Potential for Yemeni equivalent BBO+ fairway

◼ Somaliland remains hugely underexplored for non technical reasons –a political

discontinuity……

◼….but deep basins and a working petroleum system are both proven.

◼Vast acreage position (>40,000 sqkm)

◼ First mover advantage –acreage capture already ‘basinal scale’ –play opening

discovery gives potential for repeatability on a very large scale.

Somaliland – Exploration History

◼ Somaliland remains hugely underexplored – a genuine political discontinuity.

◼ 26 wells drilled (including 7 shallow stratigraphic tests and only 7 sited on seismic) over a period of 60 years.

During Under British Protectorate:

Mobil and Amerada explorer Somaliland Oil

During 1960 – 1984:

ONLY Shell and Conoco explorer oil in Somaliland since Somaliland was under occupation militarily and economically by Somalia.

During 1991-2025

Genel enter Somaliland oil exploration

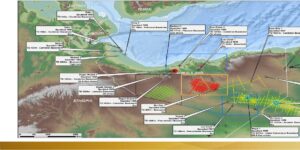

Somaliland Exploration Well Locations

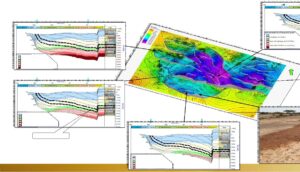

▪ Large gravity low interpreted as a sedimentary basin.

▪ NW fault trends similar to Yemen structural grain.

▪ Intra-basin gravity highs.

Rift basin architecture

confirmed

▪ Stratigraphic expansion of Upper Jurassic into NW & WNW-trending faults (c.f. Yemen).

▪ Locally >5000m sediments on PSDM data.

▪ Seismically defined “deep basin” >4000 sqkm

Play Elements – Primary Source Rock Presence

◼ Primary Source Rock – Kimmeridgian Daghani Shale

(equivalent to prolific Madbi shale in Yemen) outcrops

to the North of SL10B/13 at Bihendula.

◼ 350-450 m gross thickness in outcrop (net source rock

c.30%)

◼ 2-8% TOC, up to 16 kgHC/tonne

◼ DagahShabel-1 discovery – mid-30 °API oil to surface

from Upper Jurassic carbonates.

◼ Secondary source Rock – Oxfordian Gahdoleh

formation, black shales, TOC 1-2%.

BLOCK SL10B/13

◼ Seeps identified on Block SL10B/13 and to the north

confirmed by surface passive geochemical sampling and

direct seep sampling.

◼ GCMS analysis of the seeps are consistent with light oil or possibly condensate derived from a clastic source rock.

◼ DagahShabel-1 discovery, seeps in SL10B/13 Kalis-1 and Nogal-1 shows are a strong indicator of an extensive Daghani Fmpetroleum system equivalent to the Madbi Qishn/Amran(!) petroleum system Yemen.

Play Elements –Reservoirs and Seals

Hayira seep was

- Identified in 2013/14 with satellite data

- Sampled with Gore-Sorber modules in 2014

Daghani Fm

- Additional samples collected in 2019 by pit-sampling.

RESERVOIR –multiple targets

◼ Primary QishnClastics

◼ Main producing reservoir in Yemen–Avg. 20% porosity, avg. 1500mD permeability, high NTG, ~100m net thickness.

◼ Outcrops 10 km north of Block SL10B/13.

◼ Seismic evidence for presence on-block.

◼ QishnCarbonates Top-seal

◼ Secondary reservoirs

◼ Jurassic AdrigatSandstone 50-200m thick (GahdolehTop-seal)

◼ Cretaceous Yesommaand GumburoFmSandstones 1500-2000m thick (Intra

formational top-seals proven in NogalBasin wells)

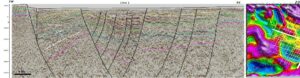

Traps (Prospects & Leads)

◼ Prospects mapped on PSDM seismic data

◼ Inventory of 12 Prospects & Leads defined

◼ Traps are predominantly 3-way dip closures against a

fault (similar to Yemen analogue)

◼ Stacked reservoir targets

◼ YesommaFm

◼ GumburoFm

◼ QishnFm(PRIMARY RESERVOIR)

◼ AdigratFm

◼ Mean closure sizes at Qishn Fm 5 to 33 km2 with large

structural upside

◼ Mean prospective resources range 50-700 MMbbls per

prospect layer (Average Qishn prospect 200 MMbbls)

◼ Stacked reservoirs resource potential gives 200-1500

MMbblsper prospect

Oil Export Feasibility Studies

◼ Third Party study investigating feasibility of exporting

oil from SL10B/13 development

◼ Best export facility likely exists at natural deepwaterPort

at Berbera

◼ Crude export to a refinery in Oman or UAE is favoured

◼ EPS (20,000 bopd) and FFD (50,000 bopd)

development options considered

◼ Oil evacuation by trucking is viable for EPS with volumes

up 20,000 bopd

◼ Oil evacuation by buried pipeline routed west of

mounta