Innovative Inclusion:

How Telesom ZAAD Brought Mobile Money to Somaliland

Introduction

In June 2009, Somaliland’s leading mobile network operator (MNO) Telesom launched Telesom ZAAD, the country’s first mobile money service. Since then, the service has gained significant traction: in June 2012, al- most 40% of Telesom GSM subscribers were active users of Telesom ZAAD. What is most striking about the service is the level of activity on the mobile money platform. Active Telesom ZAAD users perform over 30 transactions per month on average, far above the global average of 8.5 per month.1 Telesom ZAAD is one of the 14 GSMA Mobile Money Sprinters2 and is recognised as one of the most successful mobile money services in the world.

The World Bank’s Global Financial Inclu- sion Database (Findex) recently revealed that Somalia was one of the most active mobile money markets: 26% of the popula- tion reported using mobiles to pay bills, which is the highest rate in the world, and 32% to send and receive money. Most of this mobile money activity has been driven by Telesom ZAAD.

This case study details the success of Tele- som ZAAD and the factors underlying this success. The objective for Telesom’s mobile money service, in the words of its CEO, has always been to bring financial inclu- sion to Somaliland. It was this vision that ecosystem works and how the business is structured is discussed in section two of the case study.

The results of this original and ambitious mobile money strategy are presented in section three. These results frame a discus- sion of how successful Telesom ZAAD has been at functioning as a cash replacement. The case study concludes with a brief dis- cussion of the challenges facing Telesom ZAAD as they evolve their service over the coming years.

section 1

Developing a mobile money strategy for Somaliland

Telesom is the leading MNO in Somaliland with close to 1 million mobile connections (about 85% market share). Founded in 2002, Telesom is a privately held company owned by 1,500 shareholders – all Somalilanders who live locally or abroad. The Telesom CEO, Abdikarim Mohamed Eid, was also one of the seven founders of Telesom and he has been driving Telesom’s works for the past 12 years.

There is no formal banking infrastruc- ture in Somaliland and no internation- ally recognised banks operate there. Mr.Abdikarim Mohamed Eid and his manage- ment recognised the negative impact that the lack of formal financial services were having on Somaliland’s economy and that there was an opportunity for Telesom to address this issue through Telesom ZAAD. Their broader vision was to bring finan- cial services to Somalilanders, while on a strategic level the service was initially designed as a customer retention tool.

learnIng froM M-Pesa and adaPtIng the Model to soMalIland

Prior to launching Telesom ZAAD, a team of senior Telesom officers travelled to Kenya and Tanzania to study Safaricom’s and Vodacom’s M-PESA services. They learned a lot about the model, but identified some aspects of the services that would not translate to Somaliland. Telesom decided to adapt the M-PESA model to its country context in three distinct ways.

• Making the service free. In an in- terview with MMU, Mr. Abdikarim Mohamed Eid told us, “We decided to offer the service for free. The M-PESA business model was not applicable in the context of Somaliland where people are very poor and not familiar with mobile money.” Telesom ZAAD aimed to achieve an active rate of 40% of their GSM customer base before revisiting that policy.

• Using in-house agents. Telesom decided to utilise its own distribution network and not to recruit external agents. This meant relying on the stores it already owned and oper- ated with salaried employees. This decision was driven in part by the fact that there was no formal bank- ing infrastructure or suitable chain of retail stores/businesses in Somaliland equipped to deliver the service or to provide an adequate distribution solu- tion for Telesom ZAAD. Since mobile money was a completely new concept in Somaliland, Telesom management also realised that it would be challeng- ing to convince external agents to of- fer the service. For both these reasons, Telesom decided to use its own outlet network as mobile money agents.

• Including merchants from the start.

While Telesom has offered money

transfer as a core product from the start, management saw an opportunity for goods and services payments to spur growth and to help the company keep up with its growing numbers of customers. As a result, merchant acqui- sition took the place of agent acquisi- tion in the Kenyan model.

Investment and returns

From the very start, Mr. Abdikarim Mo- hamed Eid’s commitment to the service was matched by strong investment: “We decided early on to invest heavily in the service. We knew customer education would be difficult as the level of financial literacy in Somaliland was far behind that in either Kenya or Tanzania.”

An open book approach to budgeting was taken in the first year to get the service

off the ground. One quarter of the initial investment of US$ 1 million4 was put into developing the in-house platform using Telesom’s own coding and development expertise. Since Telesom ZAAD has always been treated as a separate business from Telesom’s core GSM business, it has had its own dedicated business unit from the start. Another half of the initial investment was used to build and equip the Telesom ZAAD head office where the team now works.

The investment strategy takes on a new light when the business model was discussed: Telesom ZAAD has been a free-to- use service from the start. Although this is both a financial and strategic decision, it is driven by a commitment to financial inclusion and the recognition that customer education would pose a major challenge to the success of the service.

From a financial perspective, although Telesom decided to offer its mobile money service for free, the company was able to quickly recoup its initial investments from indirect revenues:

• Savings on airtime distribution have been significant, with almost 70%

of Telesom airtime sold over Tele- som ZAAD in April 2013 rather than through scratch cards. These savings amounted to US$ 2 million in 2012, $1.8 million in 2011, and $865,000 in 2010.

• Telesom also measure increased airtime sales due to Telesom ZAAD. This represents the difference between projected sales growth and actual growth. In 2010 soon after the launch of the service, Telesom registered a 33% increase in airtime sales, 22% in 2011 and 17% in 2012.

• Finally, Telesom managed to reduce customer churn from 5% before

the launch of Telesom ZAAD to 2% in 2013.

Given the fierce competition over price for voice and SMS, indirect revenues have become essential and Telesom ZAAD is giving Telesom an important competitive distinction

sectIon 2

Implementing an effective distribution strategy and creating the mobile money ecosystem

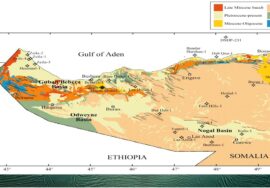

Understanding the socio-economic char- acteristics status of Somaliland was an im- portant starting point in the development of Telesom ZAAD’s distribution strategy.

In order to realise their vision of delivering financially inclusive services, Telesom chose to use a wallet-based mobile money service with a focus on keeping cash in the system. To do this, they focussed on developing a strong mobile money ecosystem around the service, which has informed its approach to both products and distribution.

coMMItMent to Merchant PayMents and salary PayMents

Telesom ZAAD was launched with a focus on salary payments and merchant pay- ments. The idea was to create a mobile money system that did not require service users to repeatedly cash-in and cash-out. Instead, Telesom ZAAD users would regu- larly receive money in their wallet (their salary, for example), maintain a small bal- ance, and use it for daily transactions, such as paying for goods and services. In order to promote both products successfully, Tele- som concentrated its efforts on two target groups: merchants and employers.

In the beginning, the team spent a lot of time educating merchants about the service. Telesom also offered free handsets to new merchants as an incentive to accept payments via Telesom ZAAD, but they quickly halted this program as merchants started to come to Telesom ZAAD even without the incentive. When Telesom ZAAD was launched in June 2009, 170 merchants had already agreed to accept payments via mobile money. Merchants were encouraged to use the e-money in their account to buy Telesom products instead of cashing out, which has helped to keep money in the system. Many mobile money services struggle to get customers drove the company to offer their service to customers for free, and it has produced a number of other unique outcomes as well, which are discussed in the first section of the case study.

To transform its vision of financial inclu- sion into a reality, Telesom’s strategy has been to develop the mobile money ecosystem around Telesom ZAAD. This ecosystem is focussed on solving two issues faced by mobile money services

around the world: getting money into the

system and then keeping it there. Most mobile money services are still functioning as a money transfer service, with custom- ers withdrawing all their funds from

the system as soon as they receive them. However, Telesom ZAAD has succeeded in convincing users to keep money in their e-wallets by building an ecosystem of sal- ary payers and merchants. Exactly how the to maintain balance but Telesom have been very successful.

Today, two members of the Telesom ZAAD team are dedicated to merchant supervision and monitor their activities on a daily basis. They also identify merchants with limited activity and visit them to understand why.

The Telesom ZAAD team knew that convincing employers to pay salaries through mobile money would be particularly chal- lenging since mobile money was so new to Somaliland. Telesom decided to lead the way, and two months before the commer- cial launch of Telesom ZAAD, it started to pay its 1,430 employees exclusively with mobile money. This was a bold decision – most mobile money providers that want to push salary payments start by paying only a small percentage (usually between 5% and 10%) of their employees’ salaries using mobile money. This helped to convince other companies to start paying their em- ployees using Telesom ZAAD.

Telesom also wanted their employees to become brand ambassadors and to start using Telesom ZAAD to pay their rent, buy goods and services, and transfer money.

As relatively high net-worth customers to their local businesses, Telesom employees promoted the service very effectively. To encourage uptake by word-of-mouth, Tele- som trained all its employees on Telesom ZAAD so that they were fluent in using and promoting the new service.

MobIle Money dIstrIbutIon

Telesom ZAAD has taken a unique ap- proach to mobile money distribution by not relying on external agents. Telesom decided to use its own retail stores ex- clusively to register new customers and offer cash-in and cash-out services. As mentioned earlier, this approach has been possible due to the unique market condi- tions in Somaliland and Telesom’s strong presence and brand recognition.

Telesom operates 178 of its own retail outlets distributed around Somaliland, which has been sufficient to reach its sub- scriber base. The 20 largest stores, which Telesom calls “dealers”, are responsible for managing the liquidity of the smaller stores. In the Telesom ZAAD model, people who work for stores that facilitate

cash-ins and cash-outs, as well as deal- ers who supervise smaller stores, are all Telesom employees. As such, they receive a monthly salary from Telesom. Offering a high-quality mobile money service is one

of their objectives and their bonus depends on whether or not they are able to reach their mobile money targets.

Interestingly, dealers are also responsible for recruiting and supervising merchants. This reflects the importance of merchants in Telesom ZAAD’s business structure. For Telesom, agents and merchants are the two ways customers can directly interact with the company, and both groups are seen as equally important. All Telesom ZAAD staff are trained to use the service when they are

hired and then given refresher training each following year. This training has ensured that staff knowledge and customer service levels are kept very high. Weak links in

the value chain are also discovered and identified quickly which, in addition to the in-house distribution system, preserves trust in the Telesom ZAAD brand.

the wIder ecosysteM

Focussing on the ecosystem has meant that Telesom ZAAD has had to connect with other key financial service stakeholders, including money changers (also called currency exchangers) and neighbouring mobile money services.

Because the Telesom ZAAD platform uses only US dollars, money changers are an im- portant part of the extended mobile money ecosystem. Telesom ZAAD customers often

Money changers on a Hargeisa street

need to change Somaliland shillings into dollars before they can perform a cash-in into their Telesom ZAAD account. Telesom ZAAD users can either go to a Telesom store to do this, or they can go to one of Somali- land’s 6,500 money changers. When they go to a money changer, Telesom ZAAD users simply have to bring Somaliland shillings and ask for the equivalent amount in US dollars to be deposited into their account.

This is performed as a traditional P2P trans- fer since money changers also have standard customer accounts. Every time they put dollar value into a Telesom ZAAD wallet, money changers are helping to facilitate and expand mobile money transactions.

sectIon 3

Results of the strategy

tipping point is visible in Figures 3 and 4). Anecdotal evidence suggests that cus- tomers and merchants began to come to Telesom ZAAD naturally, indicating that their strategy to develop an ecosystem was starting to pay off.

At the end of March 2010, less than a year after launch, Telesom ZAAD had already reached usage levels that were either slight- ly higher than global averages for transfers, disbursement, and payment transactions, or in line with global averages for cash-ins and cash-outs (see Figure 5).

buIldIng an actIve subscrIber base Telesom has put a lot of focus into build- ing an active subscriber base, for both cus- tomers and merchants. These efforts were quickly rewarded – just one year after the launch of Telesom ZAAD, over 70% of subscribers were actively using the service.

The active subscriber rate has remained at the same level ever since and has never fallen below 70 percent.

It is interesting to note that both the customer base and the merchant base have always grown hand-in-hand. Since the launch of Telesom ZAAD in June 2009, Telesom has maintained a ratio of approxi- mately 43 registered customers per regis- tered merchant. In April 2013, over 368,000 customers and 8,600 merchants were registered on Telesom ZAAD and 275,000 of these were active. This represents 35.6%

growIng transactIon voluMes (June 2009 to aPrIl 2010)

Figures 3 and 4 show the growth in volume of Telesom ZAAD’s major products: P2P transfers and bill and merchant pay- ments.6 Both charts show a similar growth curve and there is a noticeable point of inflection in April 2010.

The service was launched in June 2009, and by April 2010 awareness of the service had reached a tipping point. The impact of its marketing campaigns in rural villages became noticeable and the service began to take off. Telesom was also agile enough to respond to changing market conditions: a drought in Somaliland during this period prompted various emergency response NGOs to use Telesom ZAAD to disburse payments. This flexibility combined with extensive marketing campaigns produced telesoM Zaad as a cash rePlaceMent tool (aPrIl 2010 to March 2013)

In March 2013, customer usage of the ser-

vice had surpassed the averages of mobile money sprinters. Each active customer on average performed almost 25 P2P transfers and just over six bill payments in March 2013 alone. Meanwhile, the frequency of cash-ins and cash-outs declined from 1.3 to 0.5 respectively in March 2010 and 1.3 to 0.3 in March 2013. These are clear signs

that Telesom ZAAD is evolving into a cash replacement tool.

Telesom ZAAD’s ecosystem strategy and focus on salary payments and merchant payments have clearly worked. Custom- ers are getting money into the system through other means than just cash-in, and the money is staying in the system. Instead of cashing out, Telesom ZAAD us- ers keep a balance in their account and use

this balance to conduct transfers or make payments. This point is confirmed upon examination of the cash-in and cash-out curves that appear in Figure 6.

While customer cash-ins have continued to increase in volume since April 2010, the rate of increase has slowed down, and almost three years on the total volume is 250% greater. Customer cash-outs, on

the other hand, have increased just 50% since May 2010.

Evidence of the success of Telesom ZAAD as a cash replacement can be encapsulated neatly by examining the average balances of customers’ accounts. On 31 March 2013, 59% of customers had a positive balance in their Telesom ZAAD account, $37 on aver- age. Telesom’s analysis of account balances over time indicates that customers are now comfortable maintaining balances, as they understand there are multiple ways to use the funds. Retail merchants are also keep- ing money in the system – 83% of maintain a positive balance of $352 on average.

One way to assess the extent to which a mo- bile money service has been adopted is to look at how money flows into, through, and out of the system. In the case of Safaricom’s M-PESA, from October 2012 to March 2013, US$ 5.3 billion entered the system through cash-ins and $4.6 billion exited through cash-outs. The total value of all transac- tions in the system (transfers and payments excluding cash-ins and cash-outs) during this period was $6.2 billion. This means that every dollar cashed in moved through the system 1.2 times as a transfer or a payment before exiting the system. As a comparison, that ratio was just over 4.1 for Telesom ZAAD during the same period.

All evidence seems to indicate that Telesom is the first mobile money provider to create a mobile money system that is functioning effectively as a cash replacement tool.

Conclusion

Telesom has learned from the experiences of successful mobile money services in neighbouring countries and applied these lessons to Somaliland’s unique cultural and socio-economic context. Apart from the no-fee business model and internal distribution network, the major difference in Telesom’s approach is its commitment to salary payments and merchant payments. The results have been extremely encour- aging; Telesom has created a new model for mobile money whereby customers are encouraged to keep money in the system rather than cashing it out.

Telesom ZAAD will soon be facing some major challenges, however.

First, Telesom ZAAD’s active customer base recently reached 40%, and its initial plan was to revise the free-to-use business model once customer usage reached this level.

• Should Telesom start charging custom- ers to use the service?

• What could Telesom do to mitigate possible customer drop-off once charges are introduced?

Second, although the number of Telesom ZAAD customers and customer usage continue to increase, the pace has started to slow. Telesom ZAAD now must answer the same questions that many other mobile money services are asking:

• How can mobile money usage be increased among existing customers? What new services would attract new customers?

• How can new segments of the GSM subscriber base be reached?

Telesom is also discussing how they could increase their footprint in the market by extending their network of cash-in/cash- out points and recruiting external agents, which prompts these questions:

• What kinds of challenges would managing external agents create, given Telesom ZAAD’s current business structure?

• How could Telesom leverage the ecosystem around Telesom ZAAD to create new cash-in/cash-out points?

Telesom ZAAD has clearly been very suc- cessful in bringing financial services to unbanked people. Its mobile money service has changed the way people do business in Somaliland by making transactions easier, faster, and more secure. The MMU team will continue to work closely with Telesom ZAAD and to learn from them as they continue to grow and overcome new challenges.